A Firm Can Establish a Wholly Owned Subsidiary by

International-Expansion Entry Modes

Learning Objectives

After reading this department, students should be able to …

- describe the 5 mutual international-expansion entry modes.

- know the advantages and disadvantages of each entry mode.

- empathize the dynamics amid the choice of dissimilar entry modes.

The V Mutual International-Expansion Entry Modes

What is the best fashion to enter a new market place? Should a company beginning establish an export base of operations or license its products to gain feel in a newly targeted country or region? Or does the potential associated with beginning-mover status justify a bolder motion such as entering an alliance, making an acquisition, or even starting a new subsidiary? Many companies move from exporting to licensing to a college investment strategy, in result treating these choices as a learning curve. Each has distinct advantages and disadvantages. In this section, we will explore the traditional international-expansion entry modes. Across importing, international expansion is achieved through exporting, licensing arrangements, partnering and strategic alliances, acquisitions, and establishing new, wholly owned subsidiaries, as well known as greenfield ventures. These modes of inbound international markets and their characteristics are shown in Tabular array 7.1 "International-Expansion Entry Modes".1 Each mode of marketplace entry has advantages and disadvantages. Firms need to evaluate their options to choose the entry mode that all-time suits their strategy and goals.

Table 7.1 International-Expansion Entry Modes

| Type of Entry | Advantages | Disadvantages |

| Exporting | Fast entry, low risk | Low control, low local knowledge, potential negative environmental impact of transportation |

| Licensing and Franchising | Fast entry, low cost, low risk | Less control, licensee may become a competitor, legal and regulatory environment (IP and contract law) must be audio |

| Partnering and Strategic Alliance | Shared costs reduce investment needed, reduced take a chance, seen every bit local entity | Higher cost than exporting, licensing, or franchising; integration issues betwixt two corporate cultures |

| Conquering | Fast entry; known, established operations | High cost, integration issues with home role |

| Greenfield Venture (Launch of a new, wholly owned subsidiary) | Proceeds local market noesis; tin can be seen as insider who employs locals; maximum control | Loftier cost, high chance due to unknowns, tedious entry due to setup time |

Exporting

Exporting is the marketing and direct auction of domestically produced goods in another land. Exporting is a traditional and well-established method of reaching strange markets. Since it does not require that the appurtenances exist produced in the target country, no investment in foreign product facilities is required. Well-nigh of the costs associated with exporting take the class of marketing expenses.

While relatively low risk, exporting entails substantial costs and limited control. Exporters typically have little control over the marketing and distribution of their products, face high transportation charges and possible tariffs, and must pay distributors for a variety of services. What is more than, exporting does not give a company immediate experience in staking out a competitive position away, and it makes information technology difficult to customize products and services to local tastes and preferences.

Exporting is a typically the easiest way to enter an international market, and therefore about firms brainstorm their international expansion using this model of entry. Exporting is the sale of products and services in foreign countries that are sourced from the dwelling country. The advantage of this way of entry is that firms avoid the expense of establishing operations in the new country. Firms must, notwithstanding, have a way to distribute and market place their products in the new land, which they typically do through contractual agreements with a local company or distributor. When exporting, the business firm must give thought to labeling, packaging, and pricing the offering appropriately for the market. In terms of marketing and promotion, the house will need to let potential buyers know of its offerings, exist information technology through advertising, merchandise shows, or a local sales force.

Agreeable Anecdotes

I mutual gene in exporting is the need to translate something almost a production or service into the linguistic communication of the target country. This requirement may be driven past local regulations or by the company'south wish to market the production or service in a locally friendly fashion. While this may seem to exist a simple chore, information technology'southward oftentimes a source of embarrassment for the company and humor for competitors. David Ricks's book on international business blunders relates the following anecdote for Usa companies doing business in the neighboring French-speaking Canadian province of Quebec. A company boasted oflait frais usage, which translates to "used fresh milk," when information technology meant to brag oflait frais employé, or "fresh milk used." The "terrific" pens sold by some other company were instead promoted every bitterrifiantes, or terrifying. In another example, a company intending to say that its appliance could utilize "any kind of electric current," really stated that the apparatus "wore out any kind of liquid." And imagine how i visitor felt when its production to "reduce heartburn" was advertised every bit one that reduced "the warmth of heart"!2

Amongst the disadvantages of exporting are the costs of transporting goods to the land, which can be high and can have a negative impact on the environment. In addition, some countries impose tariffs on incoming goods, which will affect the firm's profits. In improver, firms that market and distribute products through a contractual understanding have less control over those operations and, naturally, must pay their distribution partner a fee for those services.

Ethics in Action

Companies are starting to consider the environmental bear upon of where they locate their manufacturing facilities. For example, Olam International, a cashew producer, originally shipped basics grown in Africa to Asia for processing. Now, however, Olam has opened processing plants in Tanzania, Mozambique, and Nigeria. These locations are close to where the nuts are grown. The issue? Olam has lowered its processing and shipping costs by 25 percentage while greatly reducing carbon emissions.iii

Also, when Walmart enters a new market, it seeks to source produce for its nutrient sections from local farms that are most its warehouses. Walmart has learned that the savings it gets from lower transportation costs and the benefit of being able to restock in smaller quantities more than offset the lower prices information technology was getting from industrial farms located further away. This practice is likewise a win-win for locals, who have the opportunity to sell to Walmart, which can increment their profits and permit them grow and hire more people and pay better wages. This, in turn, helps all the businesses in the local customs.4

Firms export generally to countries that are close to their facilities because of the lower transportation costs and the oft greater similarity between geographic neighbors. For instance, Mexico accounts for forty percentage of the goods exported from Texas.5 The Internet has as well made exporting easier. Even small firms can admission disquisitional data nigh foreign markets, examine a target market, inquiry the contest, and create lists of potential customers. Even applying for export and import licenses is becoming easier as more governments utilise the Net to facilitate these processes.

Because the cost of exporting is lower than that of the other entry modes, entrepreneurs and pocket-sized businesses are almost likely to use exporting as a way to get their products into markets around the globe. Even with exporting, firms still face the challenges of currency exchange rates. While larger firms have specialists that manage the commutation rates, small-scale businesses rarely have this expertise. I factor that has helped reduce the number of currencies that firms must deal with was the formation of the European union (Eu) and the move to a single currency, the euro, for the first fourth dimension. As of 2011, seventeen of the twenty-vii Eu members apply the euro, giving businesses access to 331 1000000 people with that single currency.half dozen

Licensing and Franchising

A visitor that wants to get into an international market quickly while taking only limited financial and legal risks might consider licensing agreements with foreign companies. An international licensing agreement allows a foreign company (thelicensee) to sell the products of a producer (thelicensor) or to utilize its intellectual holding (such equally patents, trademarks, copyrights) in exchange for royalty fees. Here'southward how information technology works: You own a company in the United states that sells coffee-flavored popcorn. You're sure that your product would be a big hit in Japan, but you don't have the resources to set up a factory or sales office in that state. You can't brand the popcorn hither and ship information technology to Nihon because information technology would get stale. So you enter into a licensing agreement with a Japanese company that allows your licensee to industry coffee-flavored popcorn using your special process and to sell it in Japan under your make proper name. In commutation, the Japanese licensee would pay you a royalty fee.

Licensing essentially permits a visitor in the target country to use the belongings of the licensor. Such property is usually intangible, such every bit trademarks, patents, and production techniques. The licensee pays a fee in exchange for the rights to use the intangible property and maybe for technical assist as well.

Because little investment on the part of the licensor is required, licensing has the potential to provide a very large return on investment. However, because the licensee produces and markets the product, potential returns from manufacturing and marketing activities may exist lost. Thus, licensing reduces cost and involves limited risk. However, information technology does non mitigate the substantial disadvantages associated with operating from a distance. As a rule, licensing strategies inhibit control and produce merely moderate returns.

Another pop way to expand overseas is to sell franchises. Nether an international franchise agreement, a company (thefranchiser) grants a strange company (thefranchisee) the right to apply its make proper noun and to sell its products or services. The franchisee is responsible for all operations but agrees to operate according to a business model established by the franchiser. In turn, the franchiser commonly provides advert, preparation, and new-product help. Franchising is a natural course of global expansion for companies that operate domestically co-ordinate to a franchise model, including restaurant chains, such every bit McDonald's and Kentucky Fried Chicken, and hotel bondage, such as Vacation Inn and Best Western.

Contract Manufacturing and Outsourcing

Because of high domestic labor costs, many U.S. companies manufacture their products in countries where labor costs are lower. This arrangement is called international contract manufacturing or outsourcing. A U.South. company might contract with a local visitor in a strange country to manufacture one of its products. It will, however, retain control of product design and development and put its own label on the finished production. Contract manufacturing is quite common in the U.Due south. wearing apparel business, with near American brands beingness fabricated in a number of Asian countries, including China, Vietnam, Indonesia, and India.[4]

Cheers to twenty-first-century it, nonmanufacturing functions can also be outsourced to nations with lower labor costs. U.South. companies increasingly draw on a vast supply of relatively inexpensive skilled labor to perform diverse business services, such as software development, accounting, and claims processing. For years, American insurance companies have processed much of their claims-related paperwork in Republic of ireland. With a large, well-educated population with English language skills, India has get a center for software development and client-telephone call centers for American companies. In the case of India, as yous can meet in Table vii.1 "Selected Hourly Wages, United States and India" , the attraction is not only a large puddle of noesis workers but likewise significantly lower wages.

Table 7.1 Selected Hourly Wages, United States and India

| Occupation | U.S. Wage per Hour (per yr) | Indian Wage per 60 minutes (per year) |

| Middle-level manager | $29.twoscore per hour ($sixty,000 per yr) | $6.thirty per hour ($13,000 per year) |

| Information technology specialist | $35.10 per hour ($72,000 per year) | $7.fifty per hour ($xv,000 per year) |

| Manual worker | $xiii.00 per hour ($27,000 per year) | $2.xx per hour ($five,000 per year) |

Source: Data obtained from "Huge Wage Gaps for the Same Work Between Countries – June 2011," WageIndicator.com, http://world wide web.wageindicator.org/main/WageIndicatorgazette/wageindicator-news/huge-wage-gaps-for-the-aforementioned-piece of work-betwixt-countries-June-2011 (Links to an external site.)Links to an external site.(accessed September 20, 2011).

Partnerships and Strategic Alliances

Some other fashion to enter a new market is through a strategic brotherhood with a local partner. A strategic brotherhood involves a contractual agreement between two or more enterprises stipulating that the involved parties will cooperate in a certain fashion for a certain fourth dimension to achieve a mutual purpose. To determine if the alliance approach is suitable for the firm, the firm must make up one's mind what value the partner could bring to the venture in terms of both tangible and intangible aspects. The advantages of partnering with a local firm are that the local firm likely understands the local civilisation, market, and ways of doing business concern better than an outside firm. Partners are especially valuable if they have a recognized, reputable brand name in the country or accept existing relationships with customers that the business firm might desire to admission. For example, Cisco formed a strategic alliance with Fujitsu to develop routers for Nihon. In the alliance, Cisco decided to co-brand with the Fujitsu name so that it could leverage Fujitsu'due south reputation in Japan for IT equipment and solutions while yet retaining the Cisco name to benefit from Cisco'southward global reputation for switches and routers.7 Similarly, Xerox launched signed strategic alliances to grow sales in emerging markets such as Central and Eastern Europe, India, and Brazil.8

Strategic alliances and articulation ventures have become increasingly popular in recent years. They allow companies to share the risks and resources required to enter international markets. And although returns also may have to be shared, they requite a company a degree of flexibility not afforded by going it lone through direct investment.

There are several motivations for companies to consider a partnership as they aggrandize globally, including (a) facilitating marketplace entry, (b) run a risk and reward sharing, (c) technology sharing, (d) joint product development, and (e) conforming to government regulations. Other benefits include political connections and distribution aqueduct access that may depend on relationships.

Such alliances ofttimes are favorable when (a) the partners' strategic goals converge while their competitive goals diverge; (b) the partners' size, market power, and resources are small compared to the industry leaders; and (c) partners are able to learn from one another while limiting access to their own proprietary skills.

What if a company wants to do concern in a foreign country but lacks the expertise or resource? Or what if the target nation'south government doesn't permit foreign companies to operate within its borders unless information technology has a local partner? In these cases, a business firm might enter into a strategic alliance with a local visitor or fifty-fifty with the authorities itself. A strategic alliance is an agreement between two companies (or a company and a nation) to pool resources in social club to achieve concern goals that benefit both partners. For case, Viacom (a leading global media visitor) has a strategic alliance with Beijing Television to produce Chinese-linguistic communication music and entertainment programming.[5]

An brotherhood can serve a number of purposes:

- Enhancing marketing efforts

- Building sales and market place share

- Improving products

- Reducing production and distribution costs

- Sharing engineering science

Alliances range in scope from breezy cooperative agreements to joint ventures—alliances in which the partners fund a separate entity (perhaps a partnership or a corporation) to manage their joint performance. Mag publisher Hearst, for example, has joint ventures with companies in several countries. So, young women in Israel can readCosmo Israel in Hebrew, and Russian women tin selection up a Russian-language version ofCosmo that meets their needs. The U.South. edition serves as a starting signal to which nationally appropriate material is added in each different nation. This approach allows Hearst to sell the magazine in more than than 50 countries.[6]

Strategic alliances are also advantageous for small entrepreneurial firms that may be likewise small to make the needed investments to enter the new market place themselves. In addition, some countries require strange-owned companies to partner with a local house if they want to enter the marketplace. For example, in Saudi Arabia, non-Saudi companies looking to do business in the land are required by law to take a Saudi partner. This requirement is common in many Middle Eastern countries. Fifty-fifty without this type of regulation, a local partner frequently helps foreign firms bridge the differences that otherwise make doing business concern locally impossible. Walmart, for example, failed several times over most a decade to effectively abound its business in United mexican states, until information technology found a strong domestic partner with similar business values.

The disadvantages of partnering, on the other mitt, are lack of straight control and the possibility that the partner's goals differ from the firm's goals. David Ricks, who has written a volume on blunders in international business organization, describes the instance of a Usa visitor eager to enter the Indian marketplace: "Information technology quickly negotiated terms and completed arrangements with its local partners. Certain required documents, however, such as the industrial license, foreign collaboration agreements, capital letter issues let, import licenses for machinery and equipment, etc., were boring in being issued. Trying to expedite governmental approval of these items, the US firm agreed to accept a lower royalty fee than originally stipulated. Despite all of this actress try, the projection was not greatly expedited, and the lower royalty fee reduced the business firm'southward profit past approximately half a million dollars over the life of the agreement."9 Failing to consider the values or reliability of a potential partner tin be plush, if not disastrous.

To avoid these missteps, Cisco created ane globally integrated team to oversee its alliances in emerging markets. Having a dedicated team allows Cisco to invest in preparation the managers how to manage the circuitous relationships involved in alliances. The squad follows a consistent model, using and sharing best practices for the benefit of all its alliances.10

Did Y'all Know?

Partnerships in emerging markets tin can be used for social practiced as well. For instance, pharmaceutical visitor Novartis crafted multiple partnerships with suppliers and manufacturers to develop, examination, and produce antimalaria medicine on a nonprofit basis. The partners included several Chinese suppliers and manufacturing partners equally well as a farm in Kenya that grows the medication'south key raw ingredient. To date, the partnership, called the Novartis Malaria Initiative, has saved an estimated 750,000 lives through the delivery of 300 million doses of the medication.11

The cardinal issues to consider in a joint venture are ownership, control, length of understanding, pricing, technology transfer, local house capabilities and resources, and government intentions. Potential bug include (a) conflict over disproportionate new investments, (b) mistrust over proprietary knowledge, (c) performance ambivalence, that is, how to "split the pie," (d) lack of parent firm back up, (e) cultural clashes, and (f) if, how, and when to terminate the human relationship.

Ultimately, nearly companies will aim at building their own presence through company-owned facilities in important international markets.Acquisitions or greenfield get-go-ups represent this ultimate commitment. Acquisition is faster, only starting a new, wholly endemic subsidiary might be the preferred option if no suitable acquisition candidates tin can be found.

Acquisitions

An conquering is a transaction in which a firm gains control of another firm by purchasing its stock, exchanging the stock for its own, or, in the case of a private business firm, paying the owners a purchase cost. In our increasingly flat world, cantankerous-edge acquisitions accept risen dramatically. In recent years, cross-edge acquisitions take made up over lx percentage of all acquisitions completed worldwide. Acquisitions are appealing because they requite the company quick, established admission to a new market. However, they are expensive, which in the past had put them out of reach as a strategy for companies in the undeveloped world to pursue. What has changed over the years is the forcefulness of different currencies. The higher interest rates in developing nations has strengthened their currencies relative to the dollar or euro. If the acquiring business firm is in a country with a strong currency, the acquisition is comparatively cheaper to make. As Wharton professor Lawrence G. Hrebiniak explains, "Mergers fail because people pay also much of a premium. If your currency is strong, y'all tin can get a bargain."12

When deciding whether to pursue an conquering strategy, firms examine the laws in the target country. China has many restrictions on foreign buying, for example, but even a adult-world land like the United States has laws addressing acquisitions. For instance, you must be an American denizen to ain a Television receiver station in the United states of america. Likewise, a strange firm is not allowed to own more than 25 percent of a US airline.13

Acquisition is a good entry strategy to choose when scale is needed, which is specially the case in certain industries (e.chiliad., wireless telecommunications). Acquisition is also a good strategy when an industry is consolidating. Still, acquisitions are risky. Many studies accept shown that betwixt 40 per centum and 60 percent of all acquisitions fail to increase the market value of the caused company by more than the amount invested.14

Foreign Directly Investment and Subsidiaries

Many of the approaches to global expansion that nosotros've discussed and then far allow companies to participate in international markets without investing in foreign plants and facilities. As markets expand, nevertheless, a business firm might decide to enhance its competitive advantage past making a directly investment in operations conducted in some other country.

Also known as foreign direct investment (FDI), acquisitions and greenfield start-ups involve the straight buying of facilities in the target land and, therefore, the transfer of resources including upper-case letter, technology, and personnel. Direct buying provides a high degree of control in the operations and the ability to meliorate know the consumers and competitive surroundings. However, it requires a high level of resources and a high degree of commitment.

Foreign direct investment refers to the formal establishment of business organisation operations on strange soil—the edifice of factories, sales offices, and distribution networks to serve local markets in a nation other than the visitor's dwelling state. On the other hand offshoring occurs when the facilities set in the strange country replace U.S. manufacturing facilities and are used to produce appurtenances that volition be sent back to the Us for auction. Shifting product to depression-wage countries is often criticized as it results in the loss of jobs for U.S. workers.[7]

FDI is generally the most expensive delivery that a house tin can brand to an overseas market, and it'south typically driven by the size and attractiveness of the target market. For example, German and Japanese automakers, such every bit BMW, Mercedes, Toyota, and Honda, take made serious commitments to the U.South. market place: most of the cars and trucks that they build in plants in the South and Midwest are destined for sale in the United States.

A common form of FDI is the foreign subsidiary: an independent company owned by a foreign firm (chosen theparent). This approach to going international non merely gives the parent visitor full access to local markets just too exempts it from whatever laws or regulations that may hamper the activities of foreign firms. The parent company has tight command over the operations of a subsidiary, merely while senior managers from the parent company often oversee operations, many managers and employees are citizens of the host land. Not surprisingly, nearly very large firms have strange subsidiaries. IBM and Coca-Cola, for example, have both had success in the Japanese market place through their strange subsidiaries (IBM-Japan and Coca-Cola–Nihon). FDI goes in the other direction, as well, and many companies operating in the Us are in fact subsidiaries of foreign firms. Gerber Products, for example, is a subsidiary of the Swiss company Novartis, while Finish & Shop and Giant Nutrient Stores belong to the Dutch company Royal Ahold.

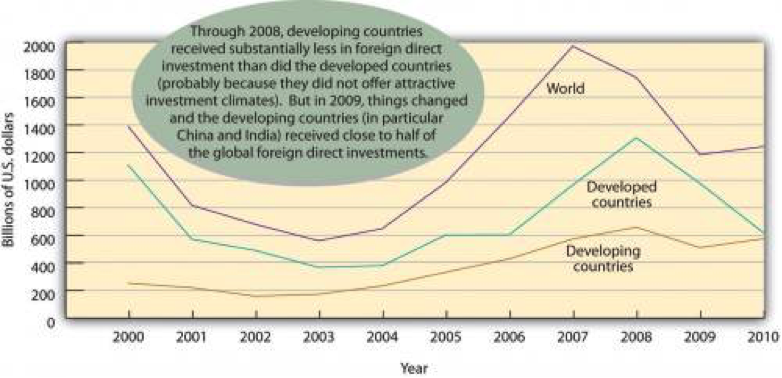

Where does most FDI capital end upward? Figure 7.3 "Where FDI Goes" provides an overview of amounts, destinations (developed or developing countries), and trends.

Figure 7.3 Where FDI Goes

All these strategies have been successful in the loonshit of global business organisation. But success in international business involves more than only finding the best way to reach international markets. Doing global business is a complex, risky endeavor. Equally many companies accept learned the hard style, people and organizations don't practise things the aforementioned fashion abroad every bit they practise at home. What differences make global concern then tricky? That's the question that nosotros'll plow to next.

Wholly Owned Subsidiaries

Firms may desire to have a direct operating presence in the foreign country, completely nether their control. To achieve this, the company can establish a new, wholly owned subsidiary (i.e., a greenfield venture) from scratch, or it can purchase an existing company in that country. Some companies purchase their resellers or early partners (every bit Vitrac Egypt did when it bought out the shares that its partner, Vitrac, owned in the equity articulation venture). Other companies may purchase a local supplier for direct command of the supply. This is known equally vertical integration.

Establishing or purchasing a wholly endemic subsidiary requires the highest commitment on the part of the international business firm, considering the firm must assume all of the risk—fiscal, currency, economic, and political.

The process of establishing of a new, wholly endemic subsidiary is often complex and potentially costly, but it affords the business firm maximum control and has the most potential to provide in a higher place-average returns. The costs and risks are high given the costs of establishing a new business performance in a new country. The firm may have to acquire the knowledge and expertise of the existing marketplace past hiring either host-country nationals—possibly from competitive firms—or plush consultants. An advantage is that the firm retains control of all its operations.

Did Y'all Know: McDonald's International

McDonald's has a plant in Italia that supplies all the buns for McDonald'southward restaurants in Italian republic, Greece, and Malta. International sales has accounted for as much as sixty pct of McDonald'due south almanac acquirement.15

Cautions When Purchasing an Existing Foreign Enterprise

As we've seen, some companies opt to purchase an existing company in the foreign country outright as a mode to become into a foreign market quickly. When making an acquisition, due diligence is important—non simply on the financial side merely also on the side of the state's culture and business concern practices. The annual disposable income in Russia, for example, exceeds that of all the other BRIC countries (i.e., Brazil, India, and China). For many major companies, Russian federation is also big and too rich to ignore as a market. Even so, Russia too has a reputation for corruption and cerise tape that even its highest-ranking officials acknowledge. In aBusinessWeek article, presidential economic advisor Arkady Dvorkovich (whose office in the Kremlin was once occupied by Soviet leader Leonid Brezhnev), for example, advises, "Investors should choose wisely" which regions of Russia they locate their business in, warning that some areas are more than corrupt than others. Abuse makes the earth less apartment precisely because it undermines the viability of legal vehicles, such every bit licensing, which otherwise lead to a flatter world.

The civilisation of corruption is even embedded into some Russian visitor structures. In the 1990s, laws inadvertently encouraged Russian firms to found legal headquarters in offshore tax havens, like Cyprus. A revenue enhancement haven is a land that has very advantageous (depression) corporate income taxes.

Businesses registered in these offshore tax havens to avoid certain Russian taxes. Even though companies could obtain a refund on these taxes from the Russian authorities, "the procedure is so complicated you never actually get a refund," said Andrey Pozdnyakov, cofounder of Siberian-based Elecard, in the sameBusinessWeek article.

This offshore registration, unfortunately, is a danger sign to potential investors like Intel. "We can't invest in companies that have even a slight shadow," said Intel's Moscow-based regional director Dmitry Konash about the complex construction predicament. sixteen

Did You Know: Business Collaborations in China

Some strange companies believe that owning their ain operations in China is an easier option than having to bargain with a Chinese partner. For case, many foreign companies still fearfulness that their Chinese partners will larn too much from them and get competitors. However, in virtually cases, the Chinese partner knows the local culture—both that of the customers and workers—and is better equipped to deal with Chinese hierarchy and regulations. In addition, even wholly owned subsidiaries can't exist totally independent of Chinese firms, on whom they might have to rely for raw materials and shipping as well as maintenance of government contracts and distribution channels.

Collaborations offering different kinds of opportunities and challenges than cocky-handling Chinese operations. For well-nigh companies, the local nuances of the Chinese market make some course of collaboration desirable. The companies that opt to self-handle their Chinese operations tend to be very large and/or have a proprietary technology base of operations, such as high-tech or aerospace companies—for example, Boeing or Microsoft. Even and so, these companies tend to hire senior Chinese managers and consultants to facilitate their marketplace entry then help manage their expansion. Nevertheless, navigating the local Chinese bureaucracy is tough, even for the most-experienced companies.

Let'south take a deeper expect at 1 company's entry path and its wholly owned subsidiary in China. Embraer is the largest aircraft maker in Brazil and ane of the largest in the globe. Embraer chose to enter China equally its first foreign market, using the joint-venture entry mode. In 2003, Embraer and the Aviation Manufacture Corporation of China jointly started the Harbin Embraer Aircraft Industry. A year later, Harbin Embraer began manufacturing shipping.

In 2010, Embraer announced the opening of its first subsidiary in China. The subsidiary, called Embraer China Aircraft Technical Services Co. Ltd., will provide logistics and spare-parts sales, as well as consulting services regarding technical issues and flight operations, for Embraer shipping in Mainland china (both for existing aircraft and those on order). Embraer will invest $18 one thousand thousand into the subsidiary with a goal of strengthening its local customer back up, given the steady growth of its business organisation in Mainland china.

Guan Dongyuan, president of Embraer China and CEO of the subsidiary, said the establishment of Embraer Red china Shipping Technical Services demonstrates the company's "long-term commitment and confidence in the growing Chinese aviation market."17

Building Long-Term Relationships

Developing a good human relationship with regulators in target countries helps with the long-term entry strategy. Building these relationships may include keeping people in the countries long plenty to form practiced ties, since a deal negotiated with ane person may autumn apart if that person returns besides quickly to headquarters.

Did You lot Know: Guanxi

I of the most important cultural factors in China isguanxi (pronouncedguan shi), which is loosely defined as a connexion based on reciprocity. Even when merely coming together a new company or potential partner, it'south best to accept an introduction from a common business partner, vendor, or supplier—someone the Chinese will respect. Prc is a human relationship-based order. Relationships extend well beyond the personal side and can drive concern as well. With guanxi, a person invests with relationships much like 1 would invest with majuscule. In a sense, it'due south akin to the Western phrase "Y'all owe me one."

Guanxi can potentially be beneficial or harmful. At its all-time, it can help foster strong, harmonious relationships with corporate and government contacts. At its worst, it tin encourage bribery and corruption. Whatever the example, companies without guanxi won't accomplish much in the Chinese market. Many companies address this need by entering into the Chinese market in a collaborative arrangement with a local Chinese company. This entry selection has also been a useful style to circumvent regulations governing bribery and corruption, but it can raise ethical questions, especially for American and Western companies that have a different cultural perspective on gift giving and bribery.

Mini Example: Coca-Cola and Illy Caffé18

In March 2008, the Coca-Cola visitor and Illy Caffé Spa finalized a articulation venture and launched a premium gear up-to-beverage espresso-based java beverage. The joint venture, Ilko Coffee International, was created to bring 3 ready-to-potable coffee products—Caffè, an Italian chilled espresso-based coffee; Cappuccino, an intense espresso, blended with milk and night cacao; and Latte Macchiato, a smoothen espresso, swirled with milk—to consumers in x European countries. The products will be available in stylish, premium cans (150 ml for Caffè and 200 ml for the milk variants). All three offerings will be available in 10 European Coca-Cola Hellenic markets including Austria, Croatia, Greece, and Ukraine. Additional countries in Europe, Asia, North America, Eurasia, and the Pacific were slated for expansion into 2009.

The Coca-Cola Company is the world's largest beverage company. Forth with Coca-Cola, recognized as the world's most valuable make, the company markets 4 of the globe's top v nonalcoholic sparkling brands, including Diet Coke, Fanta, Sprite, and a wide range of other beverages, including diet and light beverages, waters, juices and juice drinks, teas, coffees, and energy and sports drinks. Through the world'due south largest potable distribution system, consumers in more than 200 countries enjoy the visitor'south beverages at a rate of 1.v billion servings each day.

Based in Trieste, Italy, Illy Caffé produces and markets a unique blend of espresso java under a unmarried brand leader in quality. Over six million cups of Illy espresso coffee are enjoyed every twenty-four hours. Illy is sold in over 140 countries around the globe and is bachelor in more than than 50,000 of the best restaurants and coffee bars. Illy buys dark-green java direct from the growers of the highest quality Arabica through partnerships based on the mutual cosmos of value. The Trieste-based visitor fosters long-term collaborations with the world'due south best java growers—in Brazil, Primal America, Bharat, and Africa—providing know-how and technology and offering higher up-market place prices.

In summary, when deciding which fashion of entry to choose, companies should ask themselves two primal questions:

- How much of our resources are we willing to commit? The fewer the resources (i.east., money, time, and expertise) the company wants (or tin afford) to devote, the better information technology is for the company to enter the foreign market place on a contractual ground—through licensing, franchising, management contracts, or turnkey projects.

- How much control do nosotros wish to retain? The more control a visitor wants, the better off it is establishing or ownership a wholly owned subsidiary or, at to the lowest degree, entering via a articulation venture with carefully delineated responsibilities and accountabilities between the partner companies.

Regardless of which entry strategy a company chooses, several factors are always important.

- Cultural and linguistic differences. These affect all relationships and interactions inside the visitor, with customers, and with the government. Understanding the local business concern culture is critical to success.

- Quality and preparation of local contacts and/or employees. Evaluating skill sets and and so determining if the local staff is qualified is a key factor for success.

- Political and economic bug. Policy can modify frequently, and companies need to determine what level of investment they're willing to make, what's required to make this investment, and how much of their earnings they tin repatriate.

- Experience of the partner company. Assessing the feel of the partner company in the market—with the product and in dealing with foreign companies—is essential in selecting the right local partner.

Companies seeking to enter a foreign market place need to do the following:

- Inquiry the foreign market thoroughly and acquire most the country and its civilisation.

- Understand the unique business and regulatory relationships that affect their industry.

- Employ the Internet to identify and communicate with appropriate foreign trade corporations in the country or with their ain government's embassy in that country. Each embassy has its own trade and commercial desk. For case, the US Embassy has a strange commercial desk with officers who help The states companies on how all-time to enter the local marketplace. These resources are best for smaller companies. Larger companies, with more than money and resources, usually rent top consultants to exercise this for them. They're too able to have a dedicated squad assigned to the foreign state that tin travel the land frequently for the later-phase entry strategies that involve investment.

Once a company has decided to enter the foreign marketplace, it needs to spend some time learning virtually the local business culture and how to operate within it.

Entrepreneurship and Strategy

The Chinese take a "Why not me?" attitude. As Edward Tse, author ofThe Cathay Strategy: Harnessing the Power of the World's Fastest-Growing Economic system, explains, this means that "in all corners of Communist china, there will exist people asking, 'If Li Ka-shing [the chairman of Cheung Kong Holdings] tin be so wealthy, if Bill Gates or Warren Buffett can be then successful, why not me?' This cuts across People's republic of china's demographic profiles: from people in big cities to people in smaller cities or rural areas, from older to younger people. There is a huge dynamism among them."19 Tse sees entrepreneurial Communist china equally "entrepreneurial people at the grassroots level who are very contained-minded. They're very quick on their feet. They're prone to fearless experimentation: imitating other companies here and there, trying new ideas, and so, if they fail, apace adapting and moving on." As a result, he sees China condign not only a very large consumer market just also a strong innovator. Therefore, he advises US firms to enter China sooner rather than later so that they can take advantage of the opportunities there. Tse says, "Companies are coming to realize that they need to integrate more and more of their value bondage into China and India. They need to exist close to these markets, considering of their size. They need the ability to understand the needs of their customers in emerging markets, and plow them into product and service offerings quickly."twenty

REFERENCES

- [1]Fine Waters Media, "Bottled H2o of France," http://www.finewaters.com/Bottled_Water/France/Evian.asp (Links to an external site.)Links to an external site. (accessed May 25, 2006).

- [ii]H. Frederick Gale, "Mainland china's Growing Affluence: How Food Markets Are Responding" (U.Southward. Section of Agriculture, June 2003), http://world wide web.ers.usda.gov/Amberwaves/June03/Features/ChinasGrowingAffluence.htm (Links to an external site.)Links to an external site. (accessed May 25, 2006).

- [3]American Soybean Association, "ASA Testifies on Importance of Cathay Market to U.S. Soybean Exports," June 22, 2010, http://world wide web.soygrowers.com/newsroom/releases/2010_releases/r062210.htm (Links to an external site.)Links to an external site. (accessed Baronial 21, 2011).

- [iv]Gary Gereffi and Stacey Frederick, "The Global Wearing apparel Value Chain, Merchandise and the Crisis: Challenges and Opportunities for Developing Countries," The World Bank, Development Research Group, Trade and Integration Team, April 2010, http://www.iadb.org/intal/intalcdi/PE/2010/05413.pdf (Links to an external site.)Links to an external site. (accessed August 21, 2011).

- [5]Viacom International, "Viacom Announces a Strategic Brotherhood for Chinese Content Production with Beijing Television (BTV)," October 16, 2004, http://www.viacom.com/press.tin?ixPressRelease=80454169 (Links to an external site.)Links to an external site..

- [vi]Liz Borod, "DA! To the Skilful Life,"Page, September 1, 2004, http://world wide web.keepmedia.com/pubs/Folio/2004/09/01/574543?ba=thou&bi=1&bp=7 (Links to an external site.)Links to an external site. (accessed May 25, 2006); Jill Garbi, "Cosmo Girl Goes to Israel,"Folio, November 1, 2003, http://www.keepmedia.com/pubs/Folio/2003/11/01/293597?ba=m&bi=0&bp=7 (Links to an external site.)Links to an external site. (accessed May 25, 2006); Liz Borod, "A Passage to India,"Folio, Baronial ane, 2004, http://world wide web.keepmedia.com/pubs/Forbes/2000/10/30/1017010?ba=a&bi=one&bp=7 (Links to an external site.)Links to an external site. (accessed May 25, 2006); Jill Garbi, "A Sleeping Media Giant?"Folio, Jan 1, 2004, http://www.keepmedia.com/pubs/Folio/2004/01/01/340826?ba=m&bi=0&bp=7 (Links to an external site.)Links to an external site. (accessed May 25, 2006).

- [7]Michael Mandel, "The Real Cost of Offshoring,"Bloomberg BusinessWeek, June 28, 2007, http://www.businessweek.com/mag/content/07_25/b4039001.htm (Links to an external site.)Links to an external site., (accessed August 21, 2011).

- [8]"Global 500,"Fortune (CNNMoney), http://money.cnn.com/magazines/fortune/global500/2010/full_list/ (Links to an external site.)Links to an external site. (accessed August 21, 2011).

- [9]James C. Morgan and J. Jeffrey Morgan,Cracking the Japanese Marketplace (New York: Gratuitous Press, 1991), 102.

- [10]"Glocalization Examples—Think Globally and Human activity Locally," CaseStudyInc.com, http://www.casestudyinc.com/glocalization-examples-call back-globally-and-deed-locally (Links to an external site.)Links to an external site. (accessed August 21, 2011).

- [xi]McDonald's India, "Respect for Local Civilization," http://world wide web.mcdonaldsindia.com/loccul.htm (Links to an external site.)Links to an external site. (accessed May 25, 2006).

- [12]McDonald'southward Corp., "A Sense of taste of McDonald'south Around the Globe,"media.mcdonalds.com, http://www.media.mcdonalds.com/secured/products/international (Links to an external site.)Links to an external site. (accessed May 25, 2006).

- [13]"Glocalization Examples—Call back Globally and Human action Locally," CaseStudyInc.com, http://world wide web.casestudyinc.com/glocalization-examples-think-globally-and-human action-locally (Links to an external site.)Links to an external site. (accessed Baronial 21, 2011).

- [14]James C. Morgan and J. Jeffrey Morgan,Cracking the Japanese Marketplace (New York: Gratis Press, 1991), 117.

- [15]Anne O. Krueger, "Supporting Globalization" (remarks, 2002 Eisenhower National Security Conference on "National Security for the 21st Century: Anticipating Challenges, Seizing Opportunities, Edifice Capabilities," September 26, 2002), http://www.international monetary fund.org/external/np/speeches/2002/092602a.htm (Links to an external site.)Links to an external site. (accessed May 25, 2006).

ane. Shaker A. Zahra, R. Duane Ireland, and Michael A. Hitt, "International Expansion by New Venture Firms: International Diversity, Mode of Market Entry, Technological Learning, and Performance," Academy of Management Journal 43, no. v (October 2000): 925–50.

2. David A. Ricks, Blunders in International Business organisation (Hoboken, NJ: Wiley-Blackwell, 1999), 101.

3. Michael East. Porter and Mark R. Kramer, "The Big Idea: Creating Shared Value," Harvard Business Review , January–February 2011, accessed Jan 23, 2011, http://hbr.org/2011/01/the-big-idea-creating-shared-value/ar/pr.

4. Michael E. Porter and Mark R. Kramer, "The Big Idea: Creating Shared Value," Harvard Business Review , January–February 2011, accessed January 23, 2011, http://hbr.org/2011/01/the-large-idea-creating-shared-value/ar/pr.

five. Andrew J. Cassey, "Analyzing the Export Flow from Texas to Mexico," StaffPAPERS: Federal Reserve Bank of Dallas , No. 11, October 2010, accessed February 14, 2011, http://www.dallasfed.org/research/staff/2010/staff1003.pdf.

6. "The Euro," European Commission, accessed February xi, 2011, http://ec.europa.eu/euro/index_en.html.

vii. Steve Steinhilber, Strategic Alliances (Cambridge, MA: Harvard Business organisation Schoolhouse Printing, 2008), 113.

8. "ASAP Releases Winners of 2010 Alliance Excellence Awards," Clan for Strategic Alliance Professionals, September 2, 2010, accessed Feb 12, 2011, http://newslife.united states/technology/mobile/ASAP-Releases-Winners-of-2010-Alliance-Excellence-Awards.

ix. David A. Ricks, Blunders in International Business (Hoboken, NJ: Wiley-Blackwell, 1999), 101.

10. Steve Steinhilber, Strategic Alliances (Cambridge, MA: Harvard Business organization School Printing, 2008), 125.

11. "ASAP Releases Winners of 2010 Alliance Excellence Awards," Association for Strategic Alliance Professionals, September two, 2010, accessed September 20, 2010, http://newslife.us/technology/mobile/ASAP-Releases-Winners-of-2010-Alliance-Excellence-Awards.

12. "Playing on a Global Stage: Asian Firms Run across a New Strategy in Acquisitions Abroad and at Home," Noesis@Wharton, April 28, 2010, accessed January 15, 2011, http://noesis.wharton.upenn.edu/article.cfm?articleid=2473.

13. "Playing on a Global Stage: Asian Firms Come across a New Strategy in Acquisitions Abroad and at Abode," Knowledge@Wharton, April 28, 2010, accessed Jan xv, 2011, http://knowledge.wharton.upenn.edu/article.cfm?articleid=2473.

xiv. "Playing on a Global Stage: Asian Firms See a New Strategy in Acquisitions Abroad and at Home," Cognition@Wharton , April 28, 2010, accessed January 15, 2011, http://knowledge.wharton.upenn.edu/article.cfm?articleid=2473.

fifteen. Annual revenue in 2008 was $23.5 billion, of which 60 pct was international. Source: Suzanne Kapner, "Making Dough," Fortune, August 17, 2009, 14.

16. Source: Ballad Matlack, "The Peril and Promise of Investing in Russia," BusinessWeek, Oct 5, 2009, 48–51.

17. Source: United Press International, "Brazil'due south Embraer Expands Shipping Business into China," July 7, 2010, accessed August 27, 2010, http://www.upi.com/Business_News/2010/07/07/Brazils-Embraer-expands-shipping-business concern-into-China/UPI-10511278532701.

18. http://www.thecoca-colacompany.com/; http://www.illy.com/

19. Fine art Kleiner, "Getting China Right," Strategy and Business , March 22, 2010, accessed January 23, 2011, http://www.strategy-business.com/commodity/00026?pg=al.

20. Art Kleiner, "Getting China Right," Strategy and Business, March 22, 2010, accessed January 23, 2011, http://world wide web.strategy-business.com/article/00026?pg=al.

This folio is licensed nether a Creative Commons Attribution Non-Commercial Share-Alike License (Links to an external site) Links to an external site and contains content from a diverseness of sources published under a multifariousness of open licenses, including:

-

Original content contributed past Lumen Learning

-

Content(Links to an external site.)Links to an external site. created by Anonymous under a Creative Eatables Attribution Non-Commercial Share-Alike License (Links to an external site.)Links to an external site.

-

International Business.Authored by: anonymous.Provided by: Lardbucket.Located at:License: CC BY-NC-SA: Attribution-NonCommercial-ShareAlike

-

International Concern five. 1.0' published by Saylor Academy, the creator or licensor of this work.

-

"Entry Strategies: Modes of Entry", section 5.3 from the volume Global Strategy (v. one.0) under a Creative Eatables Attribution-NonCommercial-ShareAlike 3.0 License without attribution as requested by the work's original creator or licensor.

-

'Fundamentals of Global Strategy v. ane.0' under a Artistic Commons Attribution-NonCommercial-ShareAlike 3.0 License without attribution equally requested by the work's original creator or licensor.

-

Image of Embraer190.Authored by: Antonio Milena.Located at:http://en.wikipedia.org/wiki/Embraer#mediaviewer/File:Embraer_190.jpg.License: CC Past: Attribution

I would like to thank Andy Schmitz for his work in maintaining and improving the HTML versions of these textbooks. This textbook is adapted from his HTML version, and his projection can exist constitute hither.

Source: https://opentext.wsu.edu/cpim/chapter/7-1-international-entry-modes/

0 Response to "A Firm Can Establish a Wholly Owned Subsidiary by"

Postar um comentário